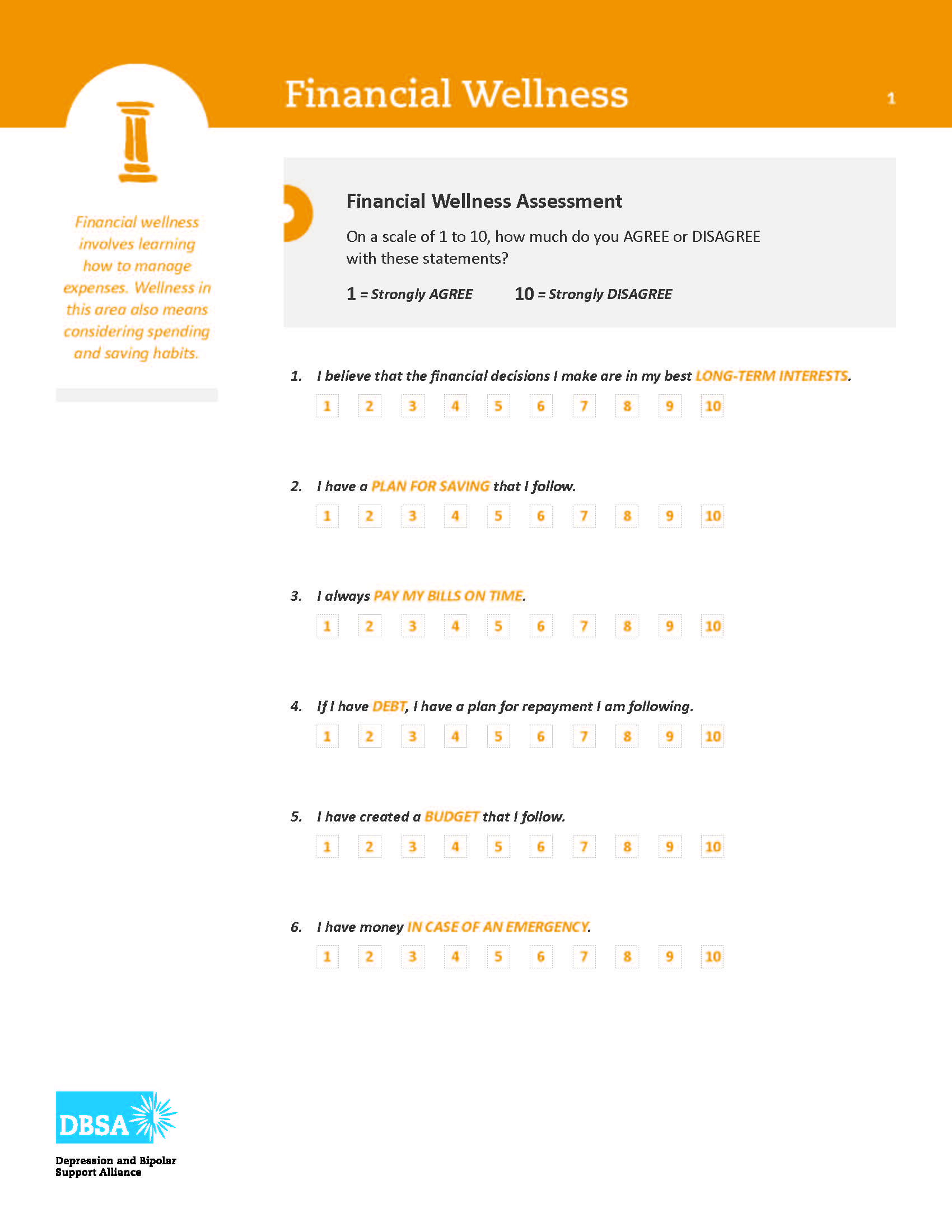

Most of us don’t enjoy talking about money, especially when it comes to budgeting. If you are living with depression or bipolar disorder, this area of your life may feel particularly overwhelming. Financial wellness means finding a way to balance spending and saving so you can feel confident about money, now and in the future.

Mood disorders and your finances

As you already know, living with depression or bipolar can have a profound impact on the way you to manage your finances. For example, have you been through times when you felt less confident, making it harder to find or keep a job? Or experienced periods of mania that triggered spending sprees, wreaking havoc on your budget or credit card accounts?

While your experiences are unique, it’s comforting to know that you’re not alone. The goal of DBSA’s Wellness Wheel is to help you recognize your strengths and empower you to build your financial health holistically. Here are some basic tips to help you get started.

Establish good habits

Building good monetary habits and safeguards during periods when you feel strong can protect you when you feel more vulnerable. There are a few steps in this process.

Track your spending

Try tracking your spending for a couple of weeks, then review where your money is going. Seeing the big picture can help you plan for success.

If day-to-day tracking is too overwhelming, check your bank’s website. If you use your debit card for purchases, some banks will categorize your expenses for you, which may give you a good overview.

Create and manage your budget

There are a number of free or inexpensive online tools that can provide a good framework. You can link accounts, set goals, and monitor your progress all from one dashboard.

Plan for the future

If you need help mapping your plans, consider working with a financial advisor. Fees can vary widely, so look at those that fit your budget. Some firms offer flat rates, which may work better if you are just getting started with saving and investing.

There are many free or low-cost online tools that can give you a good framework, including Mint and BudgetPulse. You can link accounts, set goals, and monitor your progress from one dashboard.

Know your triggers

Do you overspend when your mood is elevated? Do you self-soothe by shopping when you are feeling depressed? Charting your moods and habits can be helpful to determine when trouble might be nearing. You can also set up safeguards with your bank to limit your access to certain accounts, set alerts for unusual spending, and give a trusted person access to your activity. Taking steps like these when you’re feeling your best will help you stay on track, even when the going gets tough.

Budget tips & tricks

Creating your budget

- To build your budget, consider using an app or software program. There are plenty of versions out there, so if one platform isn’t the right fit, don’t be afraid to test a few out.

- Put in your biggest non-negotiable expenses first, including your rent or mortgage, utility payments, healthcare, groceries, and transportation expenses.

- Set a savings and investment goal for each month. Remember that it’s okay to start small, since even a few dollars set aside regularly will add up. If you have a more established income, your goal can be to set aside 6 to 12 months of living expenses in an emergency fund. Everyone has unexpected expenses along the way, from repairs to medical expenses. Preparing in advance will reduce the pressure when they do arise.

- Lastly, figure out your optional spending. It is important to give yourself some spending money for positive things that support your wellness – for example, coffee dates, clothing, and other small treats. Creating a budget that is too strict may be a recipe for impulsive buying, so manage your own expectations reasonably here.

Tips to stay on track

- Autopay bills. This is particularly important for those non-negotiable items like housing and health care. It helps to make sure these bills get paid first – and doing this will reduce the details you need to think about during the week and month.

- If you struggle with money when you feel less in control, consider not using a credit card (either temporarily or permanently).

- If you do decide to use credit, limit yourself to one card with a low spending limit. Compare cards to find the best interest rates and benefits such as cash back. Pay off the balance each month to avoid late fees and interest charges.

- If you have a trusted partner or family member, allow them to view your accounts so they can help you monitor credit usage.

- Set up multiple accounts: Create a checking account for daily expenses and for bill autopayments, and open a savings account that is less easily accessed for your emergency fund.

- If you are comfortable doing so, talk with a spouse, partner, family member or trusted friend before making large purchases.